Leverage Your Home's Value: The Benefits of an Equity Lending

When thinking about monetary options, leveraging your home's value through an equity lending can offer a tactical method to accessing additional funds. The advantages of using your home's equity can extend beyond mere convenience, supplying a series of benefits that satisfy different monetary demands. From flexibility in fund usage to potential tax advantages, equity finances provide an opportunity worth exploring for property owners looking for to enhance their monetary resources. Recognizing the nuances of equity loans and just how they can positively impact your financial portfolio is important in making informed choices for your future economic health.

Benefits of Equity Finances

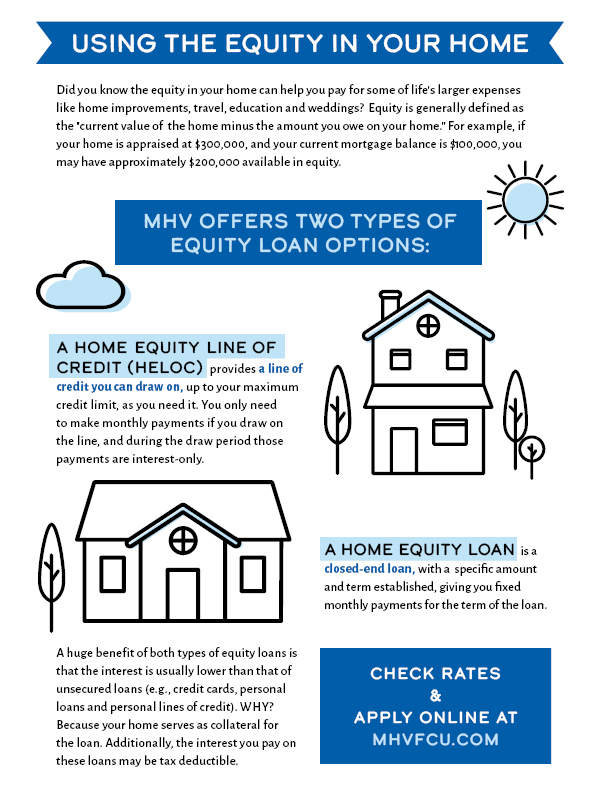

One of the primary advantages of an equity funding is the capacity to access a huge amount of money based upon the value of your home. This can be particularly beneficial for house owners that call for a substantial amount of funds for a details function, such as home enhancements, financial debt loan consolidation, or significant expenditures like medical expenses or education expenses. Unlike other sorts of car loans, an equity funding normally supplies reduced rate of interest because of the collateral given by the residential property, making it an economical borrowing choice for lots of individuals.

Moreover, equity loans usually supply much more flexibility in terms of settlement schedules and loan terms contrasted to other kinds of financing. In general, the capability to accessibility considerable amounts of money at reduced passion prices with flexible repayment options makes equity financings a valuable monetary device for house owners looking for to utilize their home's worth.

Flexibility in Fund Use

Given the beneficial borrowing terms related to equity financings, home owners can properly use the adaptability in fund usage to satisfy numerous monetary demands and goals. Equity finances provide homeowners with the freedom to utilize the borrowed funds for a vast array of purposes. Whether it's home renovations, debt loan consolidation, education and learning expenses, or unexpected medical costs, the adaptability of equity lendings enables people to resolve their economic needs effectively.

One trick benefit of equity finances is the lack of limitations on fund use. Unlike a few other sorts of loans that define how the obtained money ought to be invested, equity lendings provide customers the freedom to assign the funds as needed. This flexibility makes it possible for homeowners to adapt the loan to fit their unique circumstances and top priorities. Whether it's purchasing a brand-new organization endeavor, covering emergency expenditures, or funding a major acquisition, equity fundings empower property owners to make tactical monetary choices lined up with their goals.

Potential Tax Obligation Advantages

With equity fundings, homeowners may gain from prospective tax obligation benefits that can aid enhance their economic planning techniques. Among the primary tax advantages of an equity financing is the capacity to deduct the rate of interest paid on the loan in particular circumstances. In the United States, for example, interest on home equity financings as much as $100,000 may be tax-deductible if the funds are utilized to boost the property securing the loan. This reduction can cause considerable cost savings for qualified homeowners, making equity finances a tax-efficient means to access funds for home improvements or other certified expenses.

Additionally, making use of an equity financing to consolidate high-interest financial obligation might also lead to tax obligation advantages. By paying off credit card financial obligation or various other loans with higher rate of interest utilizing an equity finance, home owners might be able to deduct the interest on the equity finance, possibly saving a lot more cash on tax obligations. It's vital for house owners to speak with a tax expert to comprehend the details tax obligation ramifications of an equity funding based upon their private situations.

Lower Rates Of Interest

When checking out the economic benefits of equity financings, one more vital element to consider is the possibility for home owners to protect lower rate of interest - Home Equity Loans. Equity car loans typically provide reduced passion prices compared to various other forms of borrowing, such as personal financings or bank card. This is since equity loans are safeguarded by the value of your home, making them less dangerous for loan providers

Reduced rate of interest rates can lead to considerable cost financial savings over the life of the funding. Even a little percent distinction in rates of interest can translate to considerable savings in rate of interest payments. Property owners can use these savings to repay the financing much faster, develop equity in their homes more swiftly, or spend in other areas of their economic portfolio.

Additionally, reduced rate of interest can boost the total affordability of borrowing versus home equity - Alpine Credits Home Equity Loans. With lowered interest expenditures, homeowners might locate it simpler to handle their monthly settlements and maintain monetary stability. By benefiting from lower rate of interest with an equity loan, house owners can take advantage of their home's value better to satisfy their financial objectives

Faster Access to Funds

Homeowners can quicken the procedure of accessing funds by using an equity financing secured by the value of their home. Unlike other loan alternatives that may entail lengthy authorization procedures, equity lendings use a quicker course to getting funds. The equity developed in a home acts as collateral, giving loan providers higher self-confidence in prolonging credit scores, which enhances the authorization process.

With equity finances, house owners can access funds promptly, commonly receiving the cash in an issue of weeks. This quick accessibility to funds can be important in situations requiring immediate financial support, such as home renovations, clinical emergency situations, or financial debt loan consolidation. Alpine Credits Canada. By taking advantage of their home's equity, home owners can swiftly attend to pushing financial demands without prolonged waiting periods typically connected browse around this site with various other kinds of fundings

In addition, the streamlined process of equity financings translates to quicker disbursement of funds, allowing home owners to confiscate timely investment chances or take care of unforeseen expenses efficiently. In general, the expedited accessibility to funds via equity loans highlights their functionality and comfort for home owners seeking prompt financial services.

Final Thought

Unlike some various other types of lendings that define exactly how the borrowed cash must be spent, equity lendings supply debtors the autonomy to allocate the funds as required. One of the primary tax obligation benefits of an equity financing is the capacity to deduct the passion paid on the finance in particular situations. In the United States, for instance, interest on home equity finances up to $100,000 might be tax-deductible if the funds are used to enhance the property protecting the finance (Home Equity Loans). By paying off credit score card debt or other fundings with greater interest prices using an equity finance, property owners might be able to deduct the rate of interest on the equity financing, potentially conserving even more money on tax obligations. Unlike various other funding alternatives that might entail extensive approval procedures, equity finances supply a quicker course to getting funds

Comments on “Home Equity Loan Advantages: Why It's a Smart Financial Relocate”